IPFS News Link • Stock Market

"The Bond Bubble Pops":

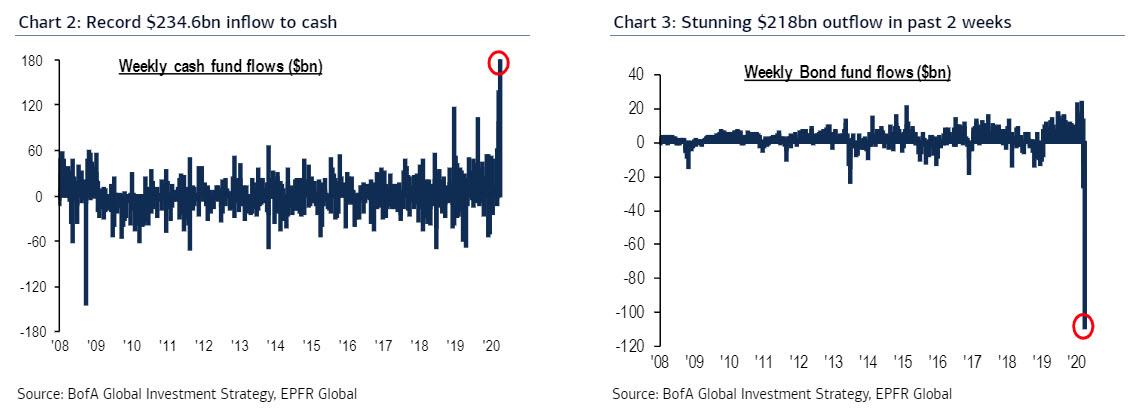

• https://www.zerohedge.com by Tyler DurdenThere is a reason why the Fed took the unprecedented step to announce it would begin buying corporate bonds this week: according to Bank of America, which is looking at the latest EPFR fund flow data, March 20 was the "bond capitulation day" when a record $34.6BN in redemption from bond funds took place.

This, together with the record outflows observed in the past two weeks which now amount to a "stunning" $218BN in bond outflows led BofA CIO Michael Hartnett to declare that the "bond bubble has popped" leading to an almost identical inflow, or $234.6BN, not into stocks but into the one asset that most certainly is not "trash": cash.

And speaking of stocks, they too got thrown out with the bondwater, as $26.2bn was redeemed from equity funds, and even $0.7bn was pulled out of gold funds.