IPFS News Link • Economy - Economics USA

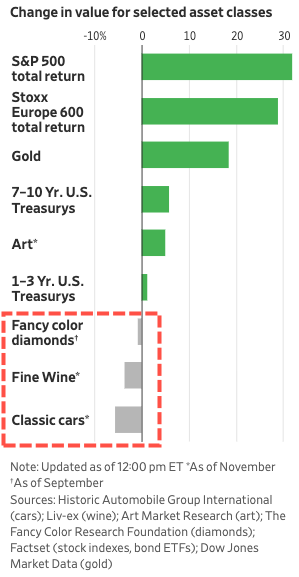

"Tail-End Of A Big Bull Market" - Wine, Diamonds, Classic Cars Are Now Money-Losing Invest

• Zero Hedge - Tyler DurdenIn the last decade, luxury assets performed exceptionally well as central bankers handed out free money to the elite class to hoard assets of their liking. And naturally, these people, with exceptional taste, bought things that the common man has only seen on television.

Now, these luxury assets are underperforming - have been for the last several years - and is a symptom of late-cycle distress.

"The froth has gone out of the market. People have realized you can't just buy stuff and expect the value to go up," said Andrew Shirley, a partner at Knight Frank and editor of the group's Wealth Report.

The Journal blames the underperformance on the global slowdown and the lack of Asian demand. Chinese buyers account for 33% of global luxury goods sales.