IPFS News Link • Federal Reserve

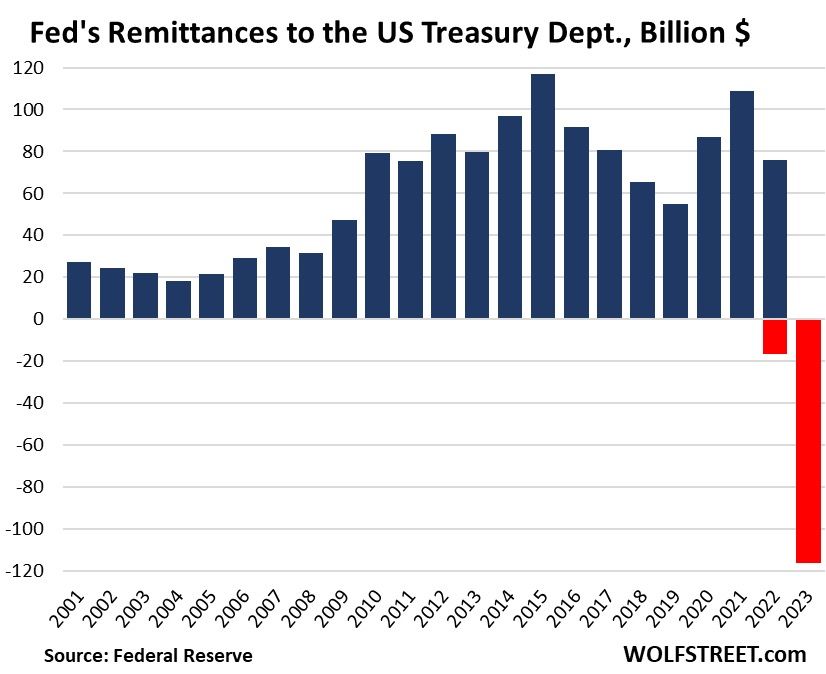

The Fed's first-ever $120 billion negative remittance to the U.S. Treasury..

• LinkedinWhen you see this chart, does that look "okay" to you or more like a big red flag? The Fed's first-ever $120 billion negative remittance to the U.S. Treasury.. It seems as if the Federal Reserve's balance sheet is in trouble. This means the Fed's income (mostly from U.S. government securities) is dwarfed by its expenses, including interest on bank reserves. A bloated balance sheet is turning from a financial asset into a liability. Bad news for effective monetary policy.. Moreover, this negative remittance means the US Treasury is getting less money, widening their federal budget deficit even more! This will highly likely lead to (even) more government borrowing, higher rates and/or potential tax hikes. Lastly, this situation will not help investor's confidence. In my opinion a huge spotlight on the unsustainability of the Fed's strategies and the overall strength of the U.S. financial position and so of the global financial system. In essence, the Fed's negative remittance is more than a financial hiccup. Please keep in mind, we aren't even in a (real) recession yet. To me, it looks like a warning signal for the economy and the stability of the financial system. We should all study money & its history now...???????? https://lnkd.in/emTxwc8B