IPFS News Link • Bitcoin

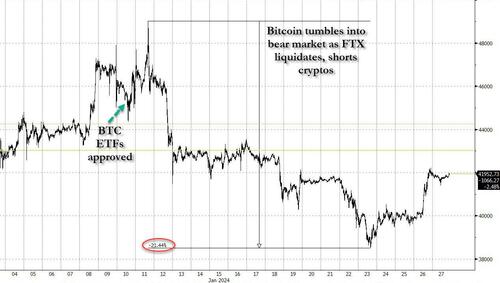

Bitcoin Slide Driven By Bankrupt FTX Liquidating, Shorting Billions

• Zero Hedge... has been the relentless liquidation of residual bitcoins by the bankrupt FTX estate which has been aggressively building up cash - and selling bitcoin into every market meltup - to maximize recoveries for stakeholders.

Specifically, as CoinDesk reported first, whereas legacy bitcoin vehicle GBTC had seen aggressive outflows at the time when the pack of new ETFs were pulling in new cash to convert into bitcoin, a large chunk of the exodus from GBTC was FTX's bankruptcy estate dumping 22 million shares, or about $1 billion of the $2.5 billion in GBTC outflows through Jan 22. And, as we pointed out, it also meant that instead of the GBTC outflows being recycled and netted off, a large portion of them was FTX liquidations - a one-off event, and not a systemic pressure on the underlying crypto asset, contrary to what some bears had said.