IPFS News Link • Housing

How Big is the US Housing Bubble?

• Mish Talk

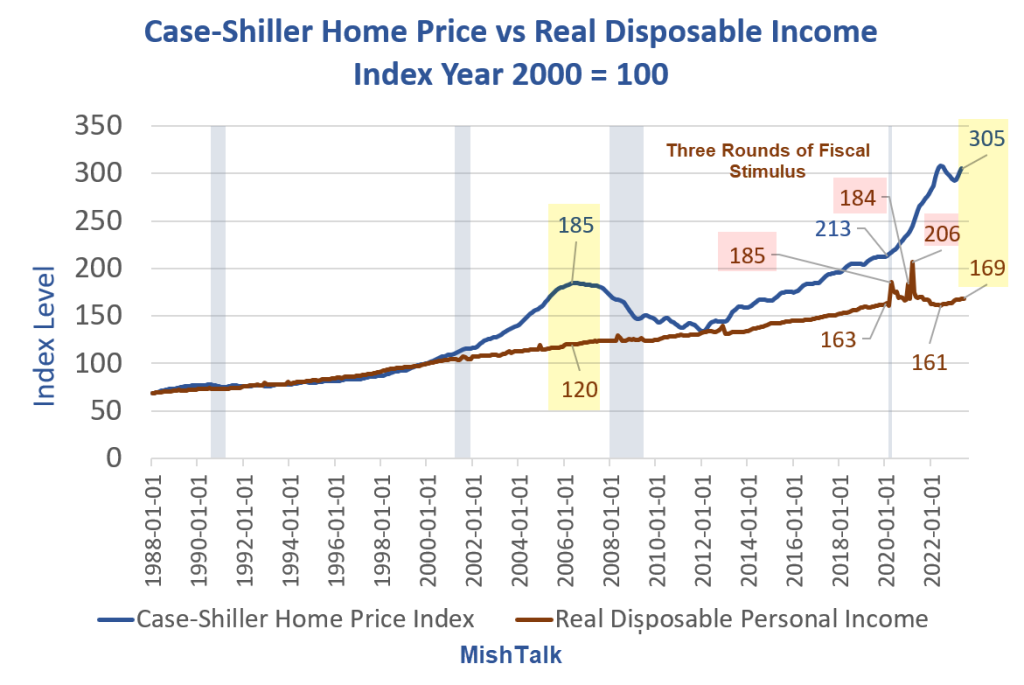

Case-Shiller home price index and Real Disposable Income via St. Louis Fed, chart by Mish.

Chart Notes

• Case-Shiller is a measure of repeat sales of the same house. This is a far better measure than average or median prices that widely vary over time by home size and amenities.

• Disposable means after taxes

• Real means inflation adjusted using the BEA's Personal Consumption Expenditures (PCE) inflation index, not the BLS Consumer Price Index (CPI).

• Both indexes are set to 2000=100.

• Case-Shiller is through May (reflective of March) while Real DPI is through June. There is a minor bit of skew that I did not factor in.

For at least 12 years, home prices followed extremely closely to real disposable personal income. In 2012 the indexes touched again at 133-134.