IPFS News Link • Business/ Commerce

Would Elon Musk Pass Billionaire Warren Buffett's Legendary CEO Test?

• CryptoCoins NewsWarren Buffett Uses The "Institutional Imperative" to Judge CEO's

Elon Musk is an undeniably brilliant individual. Take a look at Tesla, SpaceX, or even the lesser-known "The Boring Company" for evidence of his ability to create ingenious and world-changing products and solutions. Unfortunately for Elon, Warren Buffett probably finds several egregious leadership flaws in his fellow billionaire.

The concept of the "Institutional Imperative" appears in the aforementioned Berkshire Hathaway letter, where Buffett shows how he gauges competent corporate management, writing,

"(1) As if governed by Newton's First Law of Motion, an institution will resist any change in its current direction; (2) Just as work expands to fill available time, corporate projects or acquisitions will materialize to soak up available funds; (3) Any business craving of the leader, however foolish, will be quickly supported by detailed rate-of-return and strategic studies prepared by his troops; and (4) The behavior of peer companies, whether they are expanding, acquiring, setting executive compensation or whatever, will be mindlessly imitated."

Elon Musk's Rigid Tesla Approach Likely Unappetizing For Buffett

To be clear, the debate here is not whether the SpaceX boss is a competent manager in general. Instead, the question is, would Tesla ever be investable from Warren Buffett's point of view. If you take a look at rule No.1, its glaringly obvious that this could apply to Tesla right off the bat.

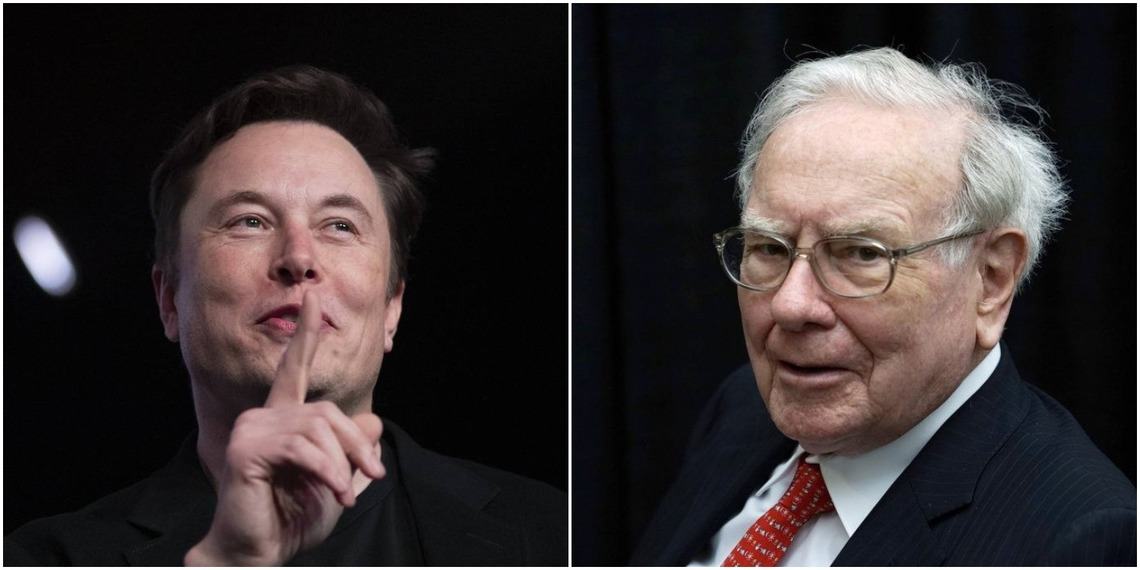

Elon Musk and Tesla ignored Warren Buffett's warning that getting into the insurance business would be a losing gamble for the EV giant. | Source: AP Photo / Jae C. Hong (i), REUTERS/Rick Wilking/Files (ii). Image Edited by CCN.