IPFS News Link • Federal Reserve

No Matter What The Fed Does, It's Bullish, Right?

• https://www.zerohedge.comIt's Bullish…Always

Last Wednesday, the Federal Reserve announced the latest decision concerning monetary policy which contained three primary components:

A cut of 25bps

Stopping balance sheet reductions (or Quantitative Tightening or Q.T.)

An outlook suggestive this may be the only rate cut for a while.

While stocks dropped on disappointment they Fed may not cut further; it didn't take long for bullish commentators to start suggesting why the cuts were supportive of higher asset prices. To wit:

"Given today's Fed decision and guidance, we remain comfortable with our view that the Fed will provide two more 25bp cuts this year (September and October)," – Bank of America.

Simply, cutting rates, and stopping Q.T., is the return of "accommodative policy" for the markets and the "ringing of Pavlov's bell." Via CNBC:

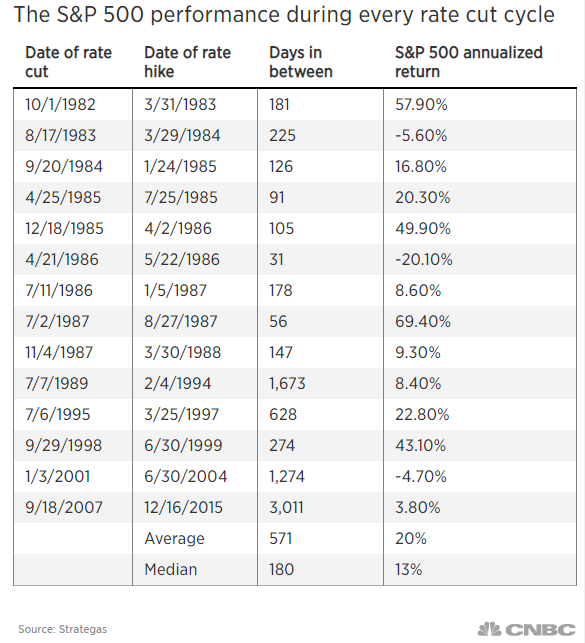

"The old investing mantra 'don't fight the Fed' stands the test of time for a reason. Going back to 1982, the average annualized return for the S&P 500 between the first rate cut and the next hike has been 20%, while the median increase has been 13%, according to Strategas. The data show investors would do well if they invest in a way that aligns with the Federal Reserve's policy direction, rather than against it, hence 'don't fight the Fed.'"

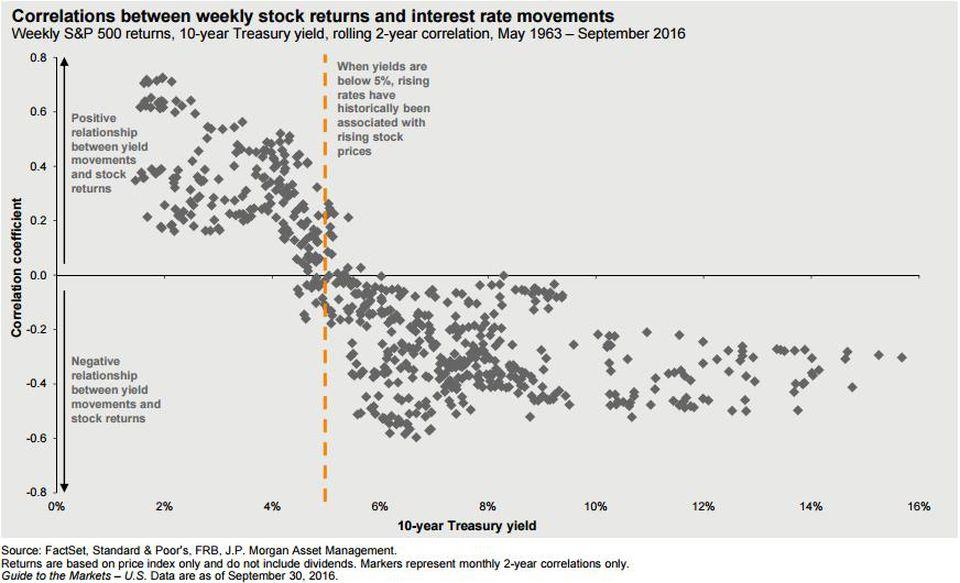

This is an interesting premise because when the Fed started hiking rates at the end of 2015, it also was bullish. Via Forbes:

"Early in a rate increase cycle, however, higher rates are actually good for the stock market. This is because rising rates, early on, signal an improving economy, and the faster growth more than compensates for higher rates."