IPFS News Link • Economy - Economics USA

Margin Debt in Freefall Is Another Reason to Worry About S&P 500

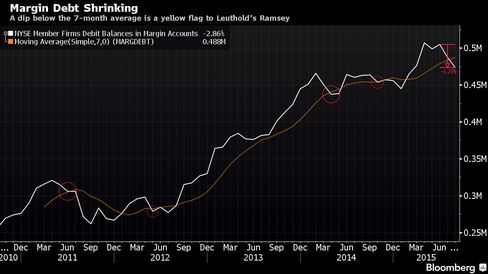

• BloombergLeuthold's Doug Ramsey cites a slip below seven-month average

NYSE margin debt has fallen more than 6 percent since July

Share on FacebookShare on Twitter

Share on LinkedInShare on RedditShare on Google+E-mail

Most people get concerned about margin debt when it's shooting up. To Doug Ramsey, the problem now is that it's falling too fast.

The chief investment officer of Leuthold Weeden Capital Management LLC, whose pessimistic predictions came true in August's selloff, says the tally of New York Stock Exchange brokerage loans flashed a bearish sign when it slid more than 6 percent in July and August. The retreat took margin debt below a seven-month moving average that suggests demand for stocks is dropping at a rate that should give investors pause.

For years, bull market skeptics have warned that surging equity credit portended disaster for U.S. shares, pointing to a threefold runup between the market low in March 2009 and the middle of this year. Ramsey, who says that surge was never strong enough to form the basis of a bear case, is now worried about how fast it's unwinding.