IPFS News Link • Economy - Economics USA

Could CLO's Blow Up the World in 2023-24?

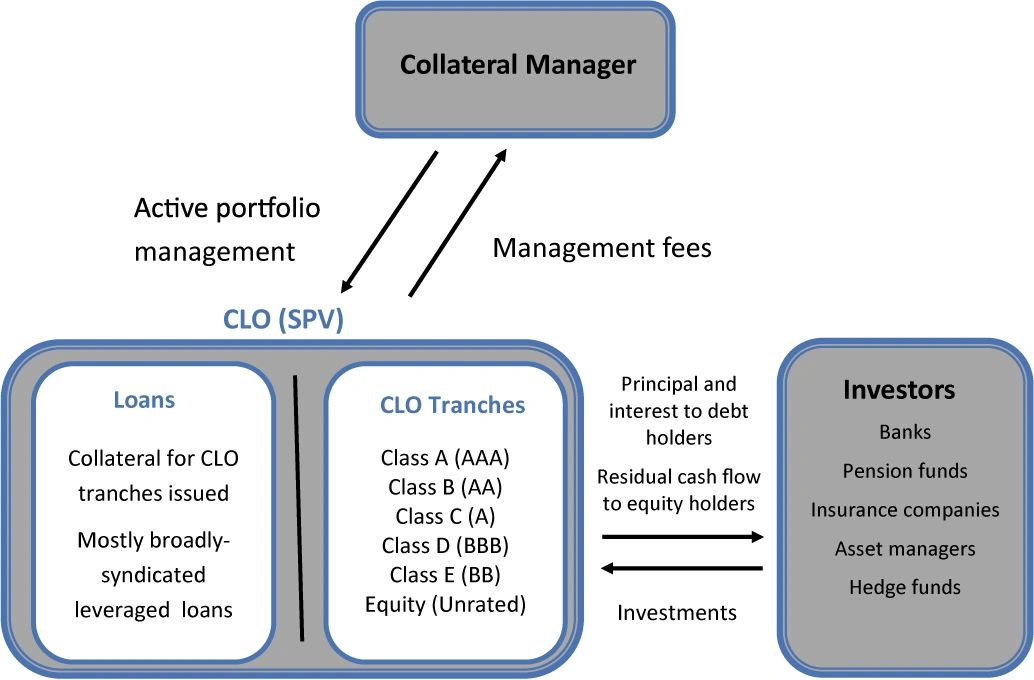

• The Economic Truth - John SneisenThese tranches, or slices, are then sold to investors as securities with varying levels of risk and return.

The CLO market has seen significant growth in recent years, with global issuance reaching a record high of $142 billion in 2018. The majority of CLOs are issued in the United States, but the market has also seen growth in Europe and Asia.

One of the key benefits of CLOs is that they provide a way for investors to access the high-yield loan market, which can offer attractive returns but can also come with greater risk. By pooling together a diverse group of loans, CLOs can also help to spread and diversify that risk. Additionally, CLOs can help to increase the liquidity of the loan market by turning illiquid loans into tradable securities.

However, CLOs have also been criticized for potentially amplifying risk and contributing to financial instability. One concern is that by pooling together a diverse group of loans, CLOs can mask the underlying credit risk of the individual loans. Additionally, the process of tranching the CLO can create a "rating arbitrage" where the lower tranches are given higher ratings than they would otherwise have received, based on the implicit guarantee provided by the higher-rated tranches.

In response to these concerns, regulatory bodies have introduced several measures to increase transparency and reduce risk in the CLO market. For example, the Dodd-Frank Wall Street Reform and Consumer Protection Act, which was passed in the United States in 2010, requires CLO issuers to retain a certain percentage of the risk of the securities they issue. Similarly, the European Union has introduced regulations that require CLO managers to retain a 5% economic interest in the CLOs they manage.

Despite these concerns and regulatory measures, the CLO market has continued to grow and evolve in recent years. One trend has been the increased use of "covenant-lite" loans in CLOs, which offer borrowers fewer restrictions and protections. While this can make the loans more attractive to borrowers, it also increases the risk for investors.

Another trend has been the increased use of "static" pools in CLOs, as opposed to the traditional "evergreen" pools that are constantly being replenished with new loans. The use of static pools can help to reduce the complexity of CLOs and increase transparency for investors, but it also means that the CLOs will eventually come to the end of their lives and will need to be repaid or refinanced.

Overall, CLOs have been a significant and growing part of the structured finance market for several years. They provide a way for investors to access the high-yield loan market, but also come with potential risks. In recent years, regulatory bodies have introduced measures to increase transparency and reduce risk in the CLO market, but the evolution of the market continues.

NY Stock Exchange 1929 Collapse

With varying levels of risk and return. Some of the risks associated with CLOs include:

1. Credit risk: CLOs are exposed to the risk of default or credit deterioration of the underlying loans.

2. Interest rate risk: Changes in interest rates can affect the value of the underlying loans and the cash flows to the different tranches of the CLO.

3. Prepayment risk: Changes in the rate of prepayments of the underlying loans can affect the cash flows to the different tranches of the CLO.

4. Liquidity risk: CLOs may have difficulty selling their assets or raising cash in a timely manner during periods of market stress.

5. Complexity: CLOs are complex financial instruments that can be difficult for investors to fully understand.

Also, Since they are based on leveraged loans, they tend to perform worse during recession as leveraged companies typically have a hard time servicing their debt.

If you are interested in the data of CLO's here are the derivatives data updated Q4 2021.

https://infogram.com/newest-us-derivative-numbers-q4-2021-1hzj4o3jm1r5o4p?live

As you can see the biggest drivers right now are Credit Risk and Interest Risk as rates have gone up fast and that puts a lot of pressure on an already 20%+ zombie corporations having to add debt to pay for loans and their dividends to investors.

Collateralized loan obligations (CLOs) are typically held by institutional investors such as banks, insurance companies, pension funds, and asset managers. Some of the largest holders of CLOs include Blackstone, Oaktree Capital Management, and Apollo Global Management. Other notable investors in CLOs include Pacific Investment Management Company (PIMCO), KKR, and Brookfield Asset Management. It's important to note that the CLO market is constantly changing and the list of the largest holders of CLOs can also change accordingly.

From what I've been told by Wallstreet experts most of these CLO's are set to come due for payouts in 2023-24. This is why I believe they will be a huge problem and potentially create the biggest blowup in finance history!

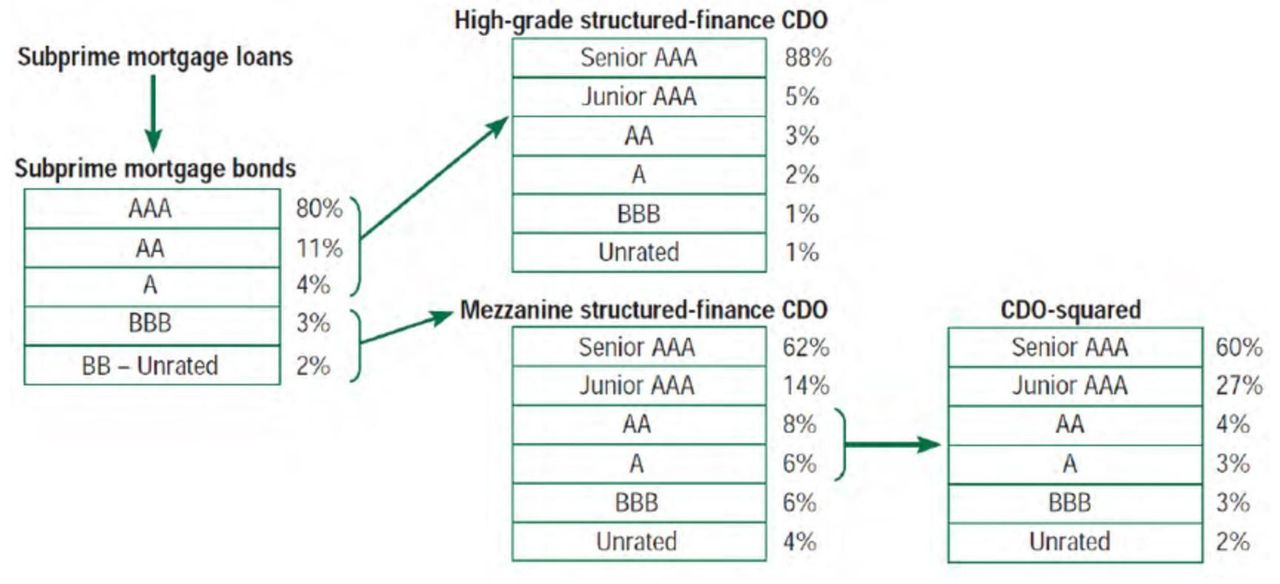

In the end I do believe there is a substantial risk for these derivatives to blow up and they are about 337.93% more than the CDO's Collateralized Debt Obligations that blew up in 2008.

CDO's Explained

John Sneisen

The Economic Truth