IPFS News Link • Inflation

The Fed Faces A "Complete Nightmare": Convincing The Public That Higher Inflation Is Good

• Zero Hedge - Tyler DurdenYesterday we explained why Bank of America, a contrarian voice among Wall Street banks, believes that hopes for an explicit announcement of Average Inflation Targeting (AIT) by Jerome Powell in his highly-anticipated speech titled "Monetary Policy Framework Review" to be delivered at 910am on Thursday which wraps up an examination of inflation which started in early 2019 among both among central bank officials and the public, will be a disappointment.

The first reason that an explicit policy would entail picking a specific time period over which PCE inflation is required to average 2% before beginning a policy normalization (hiking) process. This is a problem, because in simulations conducted by the BofA rates team, it found this could in require the Fed to remain on hold for 42 years!

Furthermore, explicit AIT could also cripple the Fed's already waning credibility, not least of all because "it would also bring up difficult issues around the appropriate time period to calculate averages and the maximum realized inflation rates the Fed would tolerate while the average climbs higher." Ultimately, BofA concludes that an explicit policy of AIT could greatly complicate both Fed communication and logistics. This would risk a reduction in the Fed's credibility, which is already vulnerable given:

-the market's pricing of inflation expectations well below 2% for the next 30 years, and

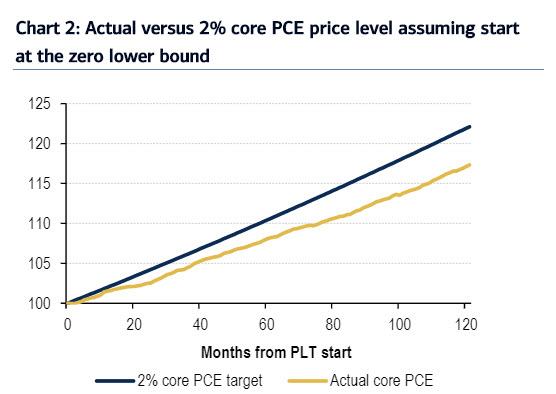

-its decade-long miss in achieving its inflation mandate

Explicit policies aside, there is the question of just what mere "forward guidance" and jawboning can do when the Fed is already at the limit of its firepower, and according to some has even crossed into illegal territory by purchasing corporate bonds. In other words, "the market is overhyping the Fed's ability to change the course of inflation in the future, under any policy." Here's why:

To begin with, interest rates are already close to 0 across the entire Treasury curve. The principle of monetary easing is to increase aggregate demand by lowering the cost of funding, theoretically increasing borrowing for spending and investment. But at the current low rates, even if the Fed were to set all Treasury rates to 0bp, how many new borrowers and spenders would emerge? This is the problem of the zero lower bound that has worried the Fed and other central banks for years. The incremental ability to ease, without adopting deeply negative rates, is limited.