IPFS News Link • Central Banks/Banking

More Than 60% Of Global Debt Now Yields Less Than 1%

• https://www.zerohedge.com by Tyler DurdenThe first one, as we touched on earlier, is that the newly printed money is unable to make its way into the broader monetary plumbing and spark the much needed inflation that will do away with the trillions in debt, although as we also noted, the Fed now has a plan to deposit digital funds directly into individual US accounts (using a "household app" in the words of former Fed economist Julia Coronado).

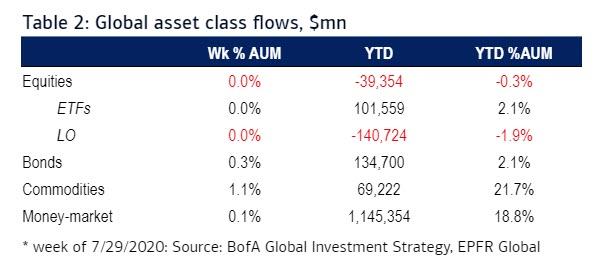

The other problem is that despite all its attempts to stimulate equity animal spirits, the bulk of new fund has flowed into bonds, not stocks. In fact, YTD equity outflows amount to $39BN while inflows to bonds and commodities are over $200BN, with a whopping $1.145 trillion going to cash via money-markets.