IPFS News Link • Gold and Silver

A Potential Crisis In Comex Gold

• Zero Hedge - Tyler DurdenAuthored by Alasdair Macleod via GoldMoney.com,

We are all used to the bullion banks covering their shorts on Comex by waiting until the speculators are over-bullish and vulnerable to mark-downs that trigger their stops. Algorithmic traders go from long to short in a heartbeat as well, and they dump contracts into a falling market, speeding up the decline. We should say at this juncture that the Managed Money speculators are short-term, attracted by futures leverage, and their gold position is often part of a wider risk strategy deployed by hedge funds. They do not intend to stand for delivery. The wider investment world taking strategic portfolio decisions does not often get involved with gold, so the Comex gold contract has been a secular play.

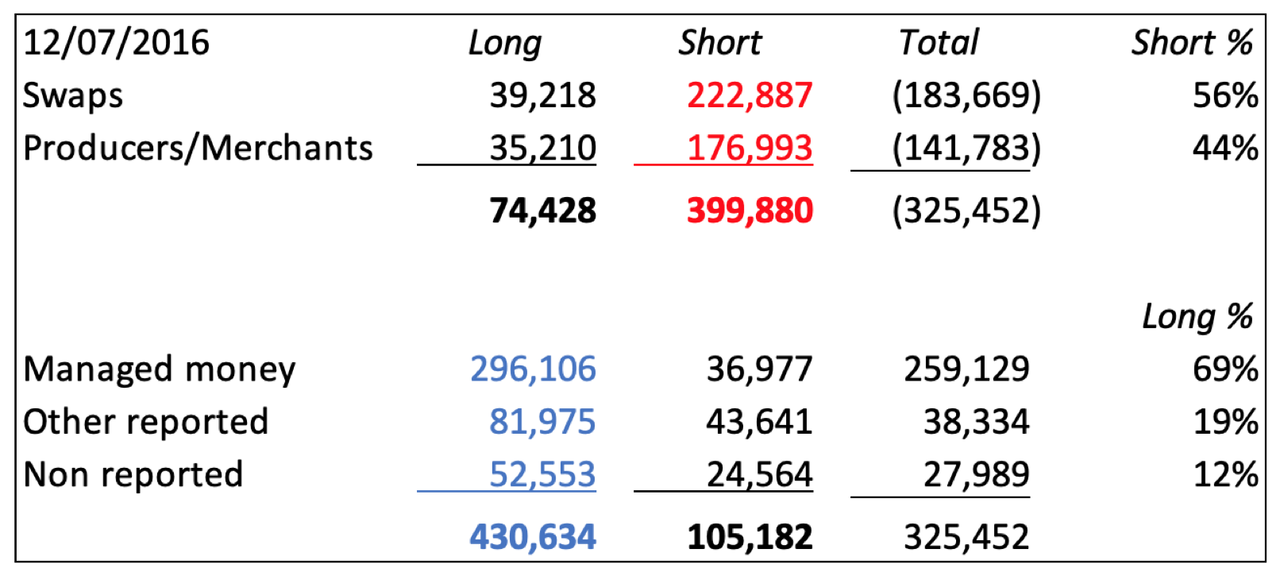

The table below shows a typical set-up, in this case July 2016. The Managed Money category (296,106 — net 259,129 contracts) is close to record long. Open interest was 633,000 contracts and the gold price was at $1360, having run up from $1040 the previous December.

In the non-speculative category, the bullion banks (Swaps) had 56% of the shorts and the Producer/Merchants 44%. Mark-to-market value of the Swaps net short position was $25bn. Of the speculative longs, the managed money category (hedge funds) held 69%, and at 296,106 long contracts it was almost a record. There was a high level of bullishness; easy pickings for the bullion banks, who by the following December drove the price down to $1120, reducing their net shorts to under 50,000 contracts.