IPFS News Link • Economy - Recession-Depression

Fed Expected To Announce CP Bailout Facility Within Hours Or Risk Money Market Panic

• Zero Hedge - Tyler DurdenAs Bank of America's rates expert, Mark Cabana - formerly of the NY Fed - writes on Saturday, "the Fed has been on fire" lately, which in light of the Fed's activities in the past two trading days of the week, may be an understatement: the Fed announced a $5 trillion (assuming max allotment) expansion to its monthly repo operations and executed purchases on Friday of $37BN out of their $80BN/month in UST firepower across the curve. As we explained at the time, the Fed needed to do this to unfreeze an increasingly broken Treasury market and to facilitate a relatively orderly unwind of highly leveraged UST positions that have likely reached loss risk limits with recent market volatility, which sparked an unprecedented VaR shock (as Cabana note, "the dealer community could not facilitate the unwind of such trades since their balance sheets were full of duration + limited ability to expand them under current regulations).

And yet, despite the unprecedented large Fed UST purchases the Fed isn't done, because as Cabana points out, not all highly leveraged UST trades have been unwound which is reflected by the fact that:

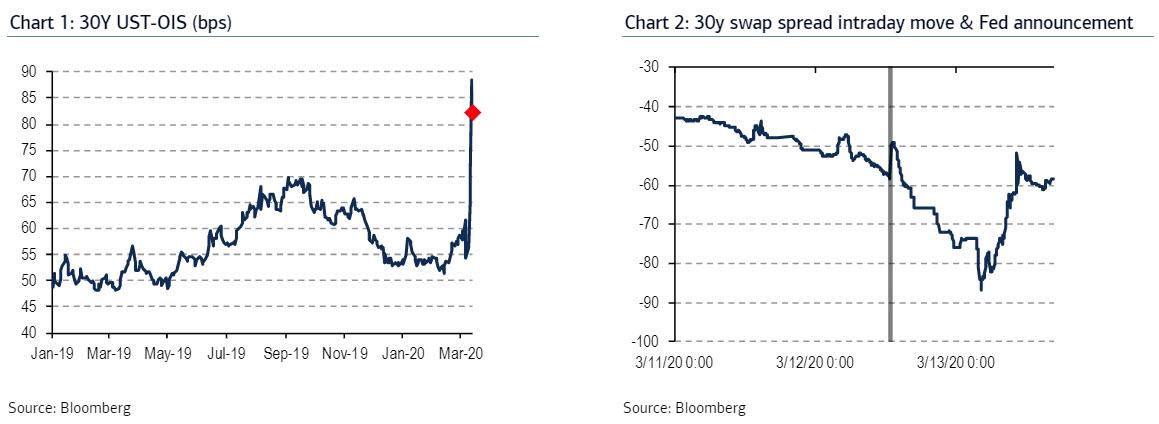

30Y USTs vs OIS have only richened marginally over recent days

30Y swap spreads have only widened back to levels last seen prior to the Fed's shift in UST purchase strategy yesterday

implied funding costs on long-dated futures contracts has not materially eased.

And hinting that more is to come, the Fed said that "the composition of the remaining purchases will be announced on Monday, March 16, 2020, around 9:00 AM."

However, with FRA/OIS exploding despite all the Fed's emergency interventions, and even JPM now admitting the world is facing a $12 trillion dollar margin call...