IPFS News Link • Business/ Commerce

Walmart Misses Across The Board As Guidance Disappoints, Online Sales Slow

• Zero Hedge - Tyler DurdenOne quarter after after Walmart shares jumped when the company reported a solid beat in its Q3 earnings report and boosted the full year outlook, it's a complete mirror image, as Walmart not only couldn't deliver on its guidance boost from just three months ago, but also delivered 2021 EPS guidance that was well below Wall Street expectations.

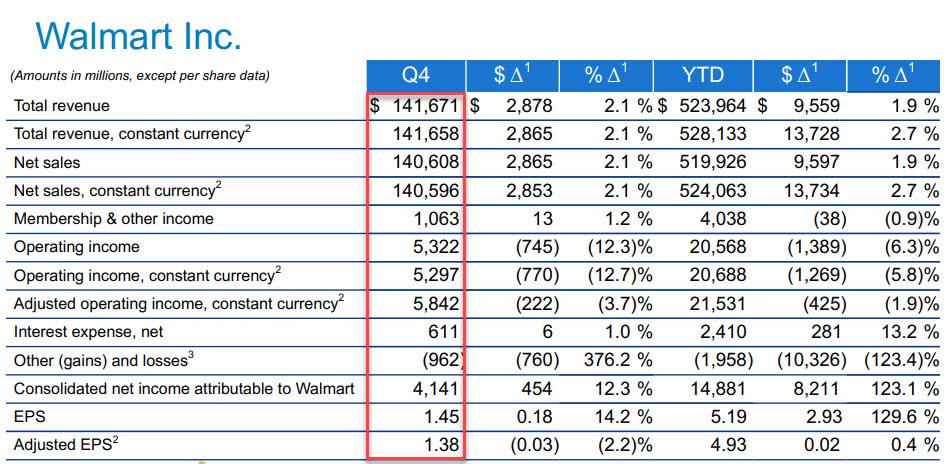

"We started and finished the quarter with momentum, while sales leading up to Christmas in our U.S. stores were a little softer than expected," Chief Executive Officer Doug McMillon said in a (under)statement. He's right: this is just how ugly the company's current quarter was:

Q4 revenue $141.61 billion, missing the consensus estimate of $142.55 billion

Q4 EPS $1.38, missing estimates of $1.44

Q4 Walmart-only U.S. stores comparable sales ex-gas +1.9%, missing estimates +2.4%

Q4 Sam's Club U.S. comparable sales ex-gas +0.8%, missing estimates +1.2%

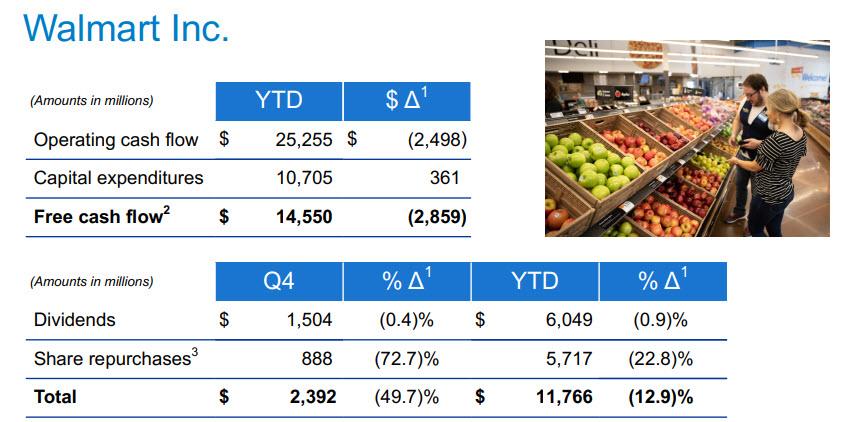

The company also reported that free cash flow for 2020 was $14.55BN, down from $17.4BN a year earlier; most of this cash was sent back to shareholders in the form of dividends ($6BN) and repurchases ($5.7BN):

More ominous was Walmart's far gloomier outlook for the coming year (at least compared to the jolly outlook published just 3 months ago):