IPFS News Link • Government Debt & Financing

Six Graphs Showing Just How Much the Government Has Grown

• By Ryan McMaken Mises.orgFederal spending and federal taxation in the United States set new records in 2019. And the federal budget deficit swelled to more than a trillion dollars. Europe is in the middle of an enormous spending binge. But apparently hard-core laissez-faire libertarian purists have taken over the world's governments.

At least, that's the case in the minds of many leftists and conservatives who have convinced themselves that "market fundamentalists" have conquered the world's institutions, and have enacted a global regime of near-zero taxation, free trade, and almost totally unregulated markets.

We hear this over an over again when everyone from The Pope to Bernie Sanders claims "neoliberalism" — a term used to "denote… a radical, far-reaching application of free-market economics unprecedented in speed, scope, or ambition" — has forged the world into a paradise for radical libertarians.

As one writer at The Guardian assures us, the UK must end the nation's "generation-long experiment in market fundamentalism." Meanwhile, Tucker Carlson insists that American policymakers "worship" markets and have a near-religious devotion to capitalism.

The neoliberal takeover is so complete, in fact, that we're told neoliberals are the ones really running the Labour Party. Meanwhile, sociologist Lawrence Busch informs us of a "neoliberal takeover" of higher education. "Free-market fundamentalists," Busch contends, have transformed America's colleges and universities into swamps of capitalist obeisance.

By What Metric?

But whenever I hear about how government intervention in the marketplace is withering away — to be replaced by untrammeled markets — I am forced to wonder what metric these people are using.

By what measure are governments getting smaller, weaker, and less involved in the daily lives of human beings?

In this country, at least, this case certainly can't be made by consulting the data on government taxation and spending.

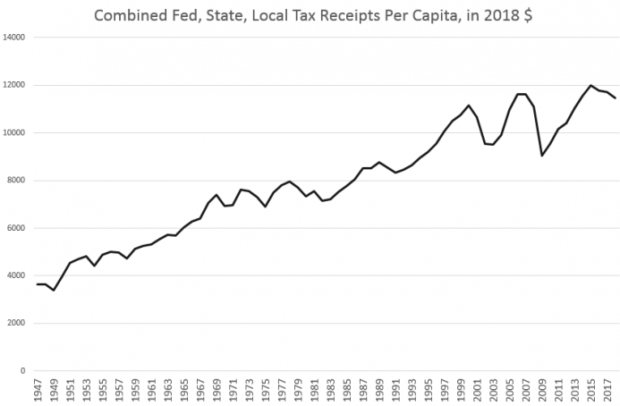

From 1960 to 2018, federal tax receipts per capita increased from $3,523 to $5,973, an increase of 70 percent.

Combining state and local taxation with federal taxes, the increase is even larger. Taxation per capita at all levels combined grew 118 percent from $5,247 in 1960 to $11,461 in 2018.

The size and scope of government isn't just growing to reflect population changes. After all, the US population only grew 81 percent from 1960 to 2018. And the federal government, embroiled in a global cold war amidst a rising tide of social programs, wasn't exactly vanishingly small in 1960.

In all these per capita graphs, I've factored in population growth because many defenders of government growth claim that governments must get larger as populations increase. Even if that were true, we can see that total spending and taxation is outpacing population growth considerably.1 But it should not simply be accepted that population growth ought to bring increases in government spending and taxation. Military defense of the United States doesn't become more expensive simply because the population grew.2 Moreover, innovation and productivity gains make products and services less expensive in a functioning private economy. This is often masked by relentless money supply inflation in the name of price "stability." But the natural progression of an economy is toward falling prices. Only with government procurements have we come to expect everything getting more expensive every year.