IPFS News Link • Federal Reserve

The Fed Is Trapped In A Rate-Cutting Box: It's The Debt, Stupid!

• Zero Hedge - Tyler Durden

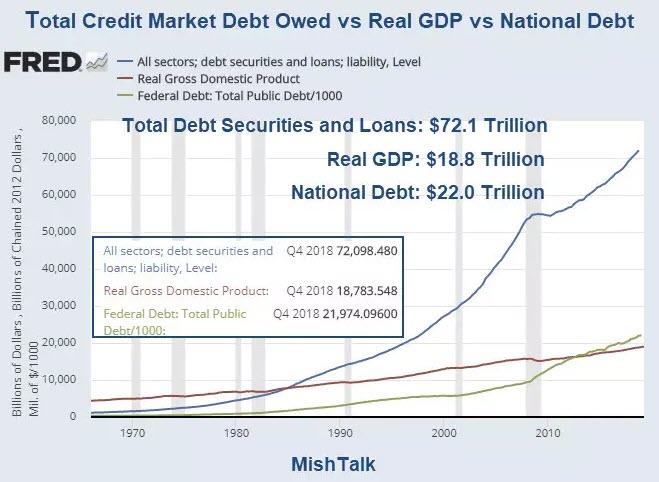

Key Debt Points

In 1984 it took $1 of additional debt to create an additional $1 of Real GDP.

As of the fourth quarter of 2018, it took $3.8 dollars to create $1 of real GDP.

As of 2013, it took more than a dollar of public debt to create a dollar of GDP.

If interest rates were 3.0%, interest on total credit market debt would be a whopping $2.16 trillion per year. That approximately 11.5% of real GDP year in and year out.

Total Credit Market Debt Detail

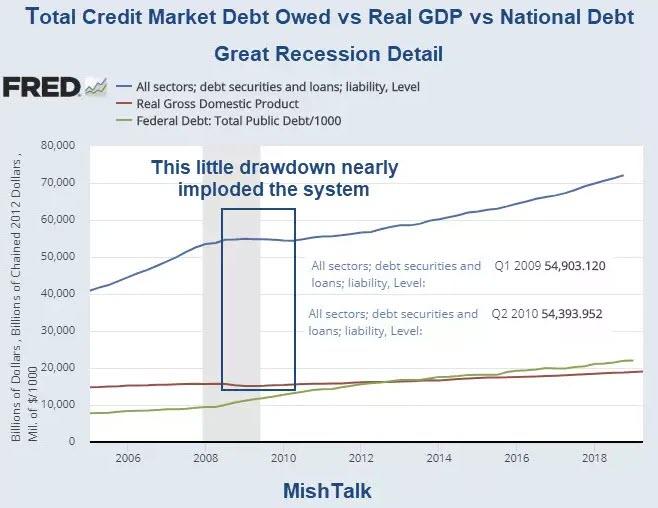

Tiny Credit Drawdown, Massive Economic Damage

Note the massive amount of economic damage caused by a tiny drawdown in credit during the Great Recession

Q. Why?

A. Leverage.

The Fed halted the Great Recession implosion by suspending mark-to-market accounting.

What will it do for an encore?

?Choking on Debt

The Fed desperately needs to force more debt into the system, but the system is choking on debt.

That's the message from the bond market.

One look at the above charts should be enough to convince nearly everyone the current model is not close to sustainable.

Here's another.

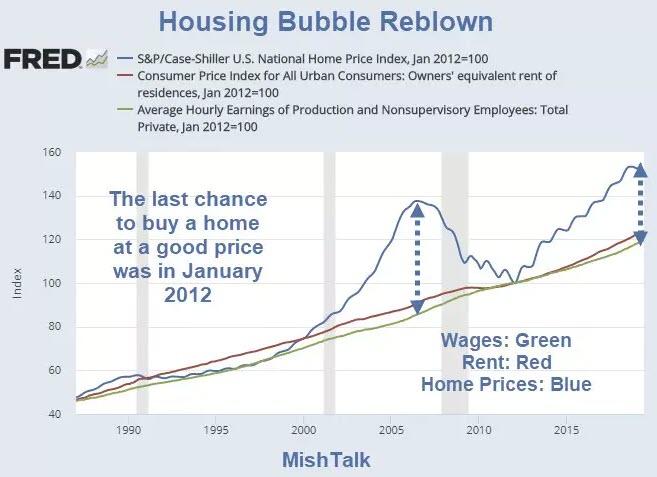

Housing Bubble Reblown

How the heck are millennials (or anyone who doesn't have a home) supposed to afford a home?

Despite the fact that Existing Homes Prices Up 88th Month, the NAR Can't Figure Out Why Sales Are Down.

Negative Yield Ponzi Scheme

Note that Negative Yield Debt Hits Record $15 Trillion, Up $1 Trillion in 2 Business Days.

So far, all of this negative-yielding debt is outside the US.

Why?

The ECB made a huge fundamental mistake. Whereas the the Fed bailed out US banks by paying interest on excess reserves, the ECB contributed to the demise of European banks, especially Italian banks and Deutsche by charging them interest on excess reserves that it forced into the system.

The demographics in Europe and Japan are worse than the US.

Tipping Point

We are very close to the tipping point where the Fed can no longer force any more debt into the system. That's the clear message from the bond market.