IPFS News Link • Business/ Commerce

People Aren't Buying . . . Here's Why

• https://www.ericpetersautos.comNew car sales are down – again – for the seventh month in a row. Which means they've been slipping all year long so far. The last time it was this slow was about ten years ago – which was the last time the car business fell down and almost couldn't get back up again.

Several factors are in play – some of them undiscussed.

One, interest rates on new car loans have been inching up slowly but steadily since 2013, when they were near zero or actually were zero (free financing).

The average rate – assuming excellent credit, which many people haven't got – is currently about 4.74 percent. It was closer to 4 percent a couple of years ago. It's still extremely low relative to the double-digit financing that was common in the '70s – but the average new car cost less then (you could buy a full-size American sedan like the 1970 Ford LTD for $22,700 in inflation-adjusted 2019 dollars) and people had more money available to buy them because they weren't hemorrhaging money on things like health insurance (and medical care, which is something different) as they are today.

The average monthly cost of health insurance for a single – and healthy – individual is almost $500. Many people are paying a great deal more.

There's less cushion in the budget now – which almost certainly explains why about half the new car loans made today are long-term (60 months or more). This is about twice as long as they were back in 1970 – when the interest rate on the average new car loan was 11.5 percent but the typical new car loan was paid off in just 36 months.

Today, it is common for people to make payments on a new car for 72 months – or even longer.

New car loans are made to seem more affordable by spreading out the payments over a longer period of time. But that doesn't mean they are more affordable.

But it may be the hidden – or at least, undiscussed – costs of new car ownership that accounts for the wilting of new car sales, in spite of still-easy financing.

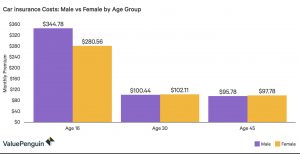

Insurance costs have been skyrocketing because of the skyrocketing repair costs of today's cars, which can suffer thousands of dollars in damage from very low-speed fender-bender accidents – because new cars no longer have bumpers.

Instead, they have pretty but fragile body-colored plastic bumper covers (the structural parts of the car designed to absorb impact forces are behind the cosmetic parts of the car) that are easily torn or torn right off the car. Often, the whole "assembly" must be replaced after a minor accident – along with incidental (but not inexpensive plastic trim pieces, such as the grille).