IPFS News Link • Economy - Economics USA

"Be Very, Very Careful" - UBS CEO Warns Policy Makers Risk Bursting The Asset Bubble

• https://www.zerohedge.comThe world's largest central banks are preparing for a policy u-turn, some have questioned whether 'more of the same' from the ECB will be enough to revive the continent's moribund economy. In fact, BlackRock CEO Larry Fink speculated that the ECB would need to start buying stocks for its stimulus to have any impact - though he acknowledged that there would be repercussions.

On Tuesday, just hours after his bank reported its best Q2 results in nine years, UBS Chief Sergio Ermotti sat down for an interview with Bloomberg and warned that the next round of monetary easing, which could begin with the ECB later this week, might risk bursting the tremendous asset bubble that has formed over the past decade of QE-driven policy.

"I'd be very, very careful about growing further the balance sheet of central banks," Ermotti said. "We are at a risk of creating an asset bubble."

If Europe wants to revive economic growth, it needs to focus on political and economic reforms, not rely on central bank money printing, which accomplishes little aside from inflating asset prices.

The ECB "can only help in a transition, it's not a solution to the problem," Ermotti said.

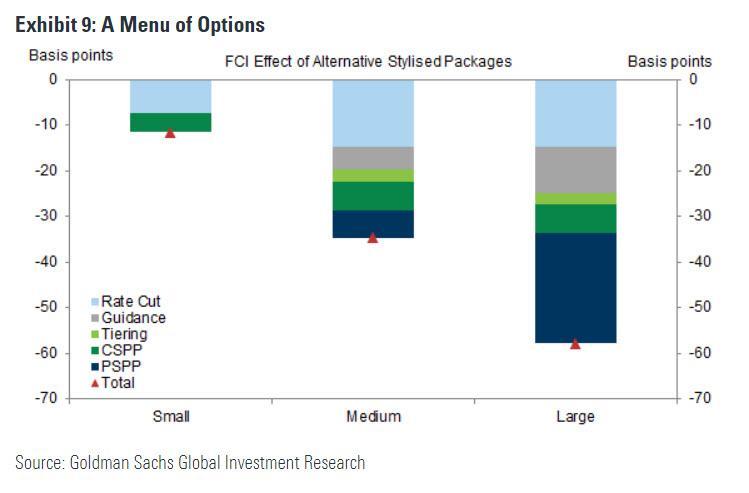

Unfortunately, at this point, the ECB is probably already set on its policy path. A team of analysts at Goldman Sachs laid out three "bundles" which Mario Draghi could unveil later this week as he sets the bank back on course for more stimulus before handing the reins to Christine Lagarde later this year. These "bundles" include small, medium and large bundles that reflect different levels of stimulus.

According to Bloomberg, money markets are pricing in a 40% chance of a 10-basis-point rate cut at Thursday's meeting. They also expect the central bank to restart its asset-purchase program later this year. Net bond purchases by central banks will soon swing back above zero.

As anybody who has been paying close attention to US markets could tell you, the "about-face" by central banks, particularly expectations that the Fed will deliver a rate cut next week, has fueled a torrid rebound in stocks and bonds, creating a growing pile of debt with negative yields, and sending US benchmarks to new highs.

Though there has been a mild recovery in US economic data this month,in Europe, the rally seems to be based solely on expectations for more central bank stimulus, and nothing further.