IPFS News Link • Federal Reserve

It's Not Just Powell Pandering To Markets - Rate Cuts Are Necessary

• https://www.zerohedge.comWe have been surprised over recent weeks to read a slue of commentary proclaiming that the economy is in great shape and Fed Chairman Powell is just pandering to markets by signaling rate cut(s) in July and beyond. Specifically, "strong" readings from the employment report, inflation and now retail sales have received much attention even as much more leading data continues to point to weakness among these very indicators in the second half of 2019. In this post we'll try to show why Chairman Powell is right to cut rates here and now and why incoming data has done little to alter the intermediate-term outlook of a slower economy ahead.

Employment

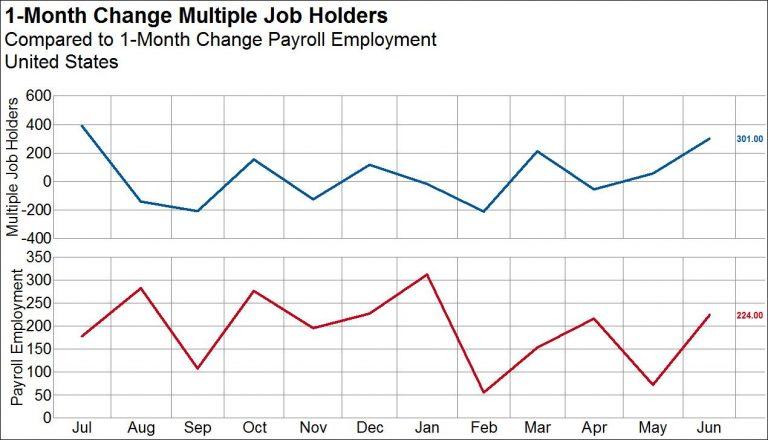

The recent employment report is probably the most misunderstood of all the recent economic data. Yes, non-farm payrolls came in at 224K vs an estimate of 160K. However, the report paints a much different picture when you lift up the hood. For example, the important hours worked component sank to a 1% YoY growth rate, a level only breached on the downside two other times during this recovery (in 2016 and 2014). More striking, though, is the fact that multiple job holders increased by 301K, outpacing total payroll growth by 77K. That means that people picking up a second job (think college-age kids picking up two summer jobs) explains the entire growth in payrolls for the month of June. Single job holders actually decreased by 77K.

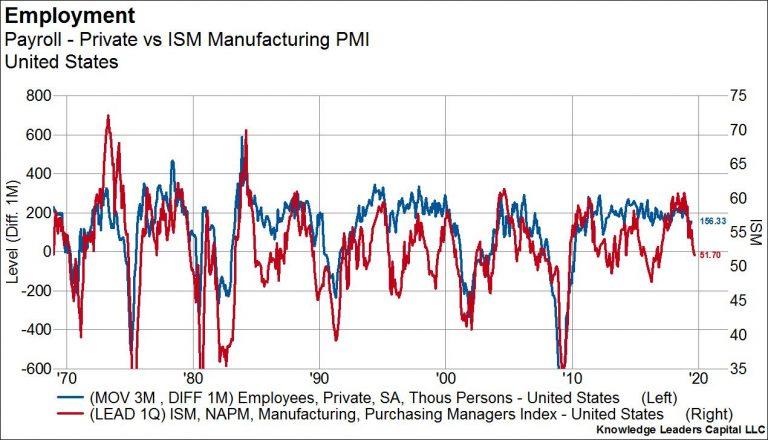

What's more, employment is a lagging indicator. It tells us practically nothing about the state of the economy now, but rather its state three months ago. The ISM manufacturing PMI, which is a leading indicator and leads payroll employment by a quarter, points to slower payroll growth in the immediate future. The ISM manufacturing PMI also points to a rise in initial unemployment claims compared to year-ago levels for at least the next quarter. Therefore, not only was the employment report not "strong", the next few employment reports could get markedly weaker as the summer progresses.