IPFS News Link • Business/ Commerce

Why US Commercial Real Estate Is Another Dangerous Bubble In The Making

• https://www.zerohedge.comWhile most people – including mainstream economists – seem to believe that our bubble problems ended when the U.S. housing bubble burst in 2008, the reality is that there are even more bubbles forming today than before the Great Recession. I listed the bubbles that I am warning about in a detailed piece that I wrote last week called "Why You Should Not Underestimate The Severity Of The Coming Recession." I believe that the bursting of these numerous bubbles is likely to cause another recession that may be even more severe than the Great Recession was. In the current piece, I will discuss the bubble that is currently forming in U.S. commercial real estate and how it is likely to burst.

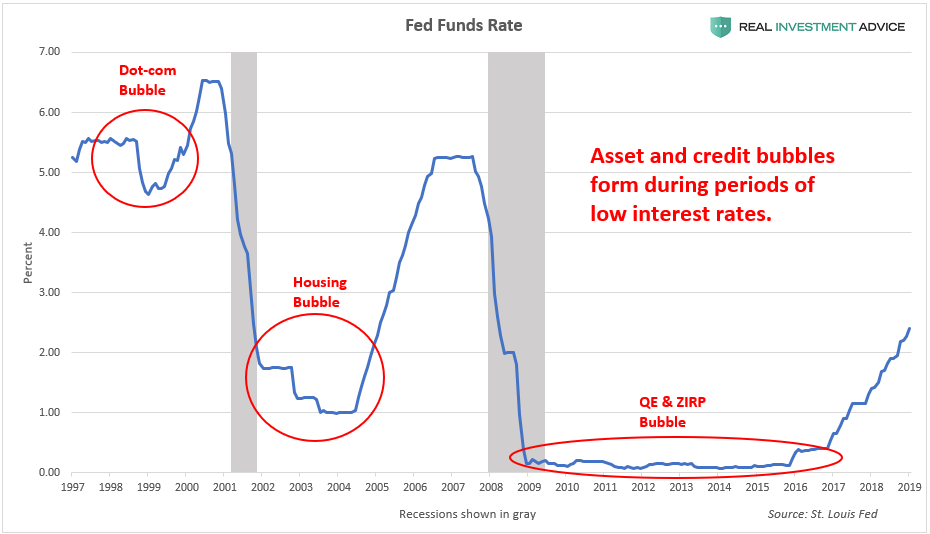

In order to understand the bubble that is currently forming in U.S. commercial real estate, it is important to first understand the extremely unusual monetary environment that the U.S. has been in since the Great Recession. After the U.S. housing and credit bubble burst in 2008, the Federal Reserve was desperate to stimulate the economy by slashing borrowing costs. The Fed cut and held interest rates at virtually zero percent (i.e., zero interest rate policy or "ZIRP") for seven years and has been gradually increasing those rates since late-2015. Unfortunately, dangerous economic bubbles form during low interest rate periods and burst when rates rise once again. The dot-com and housing bubbles formed in this manner and so are numerous other bubbles in the current cycle, including commercial real estate. Commercial real estate is particularly sensitive to interest rates, and benefits when rates are low and suffers when rates are high.

In addition to ZIRP, the Fed utilized an unconventional monetary policy known as quantitative easing or QE, which pumped $3.5 trillion dollars worth of liquidity into the U.S. financial system from 2008 to 2014. When conducting QE, the Fed creates new money digitally for the purpose of buying bonds and other assets, which helps to suppress interest rates and boost asset prices. The chart below shows the growth of the Fed's balance sheet since QE started in 2008: