IPFS News Link • Bitcoin

Why Bitcoin Is Soaring: Thank Trump And Trade War

• Zero Hedge - Tyler DurdenWith trade war between the US and China suddenly raging after a 5 month ceasefire, and on the verge of turning nuclear with China's Global Times reporting that Beijing is contemplating selling "some treasuries" as part of its response, the Chinese yuan is in freefall as trader expect the PBOC to sharply devalue the currency to offset some or all of the tariff hike using a weaker currency.

Commenting on the yuan plunge this morning, Nomura's Charlie McElligott notes that the Offshore Chinese Yuan is "being hammered", as offshore yuan implied vol explodes higher...

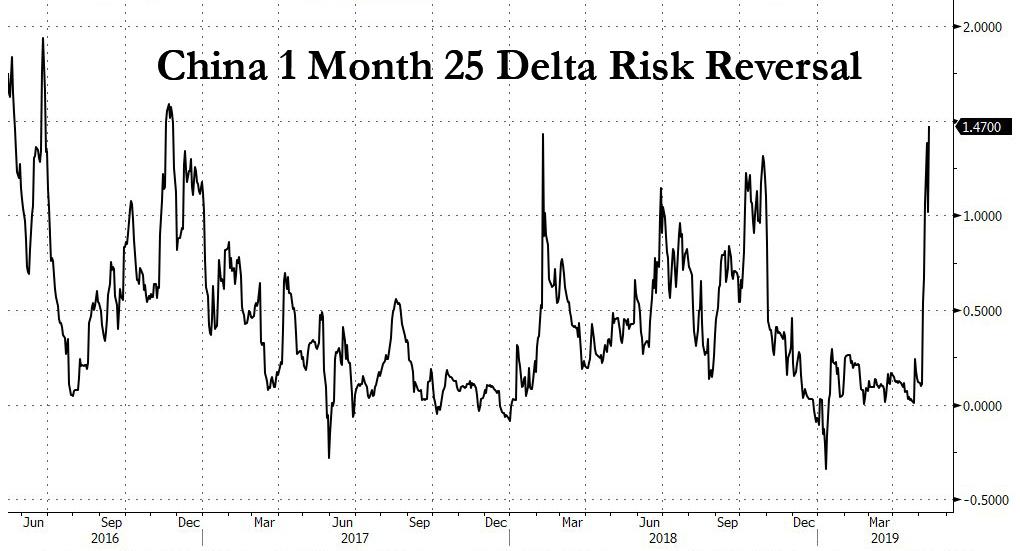

... and 1m 25d riskies surging to 2.5 year highs, as the market prices-in further Yuan weakness "anticipating that the Chinese will use it to boost exports and offset negative implications of tariff barriers...

... with again-heightening 'rate cut' potential into further economic slowdown risk, which always-ironically helped keep the overnight downside move in Chinese Equities relatively 'in check')."

It's not just China's yuan: as the Nomura quant writes, broad EMFX is also in a very tough spot, as

the US trade row with China (and expectations of Chinese retaliation to the detriment of global trade) in conjunction with

US Dollar index hovering near 15 year highs (ongoing Fed B/S QT, Fed policy rate at 11 year highs and surging UST issuance sap USD liquidity) and

Crude now reaccelerating higher on the Saudi tanker "sabotage" and various supply-pressures makes for a very challenging backdrop, as the inflationary pressures on the Crude exporting EM countries makes it difficult for their central banks to cut rates

So where is some of this EM outflow heading? The answer: crypto — as the uncanny correlation between the Yuan and Bitcoin in the chart below shows — seems like a reasonable conclusion, "as EMFX currencies are at risk of rising CB rate cut risk and destabilizing currency outflows."