IPFS News Link • Finance - Money Management

For The Average Investor, The Next Bear Market Will Likely Be The Last

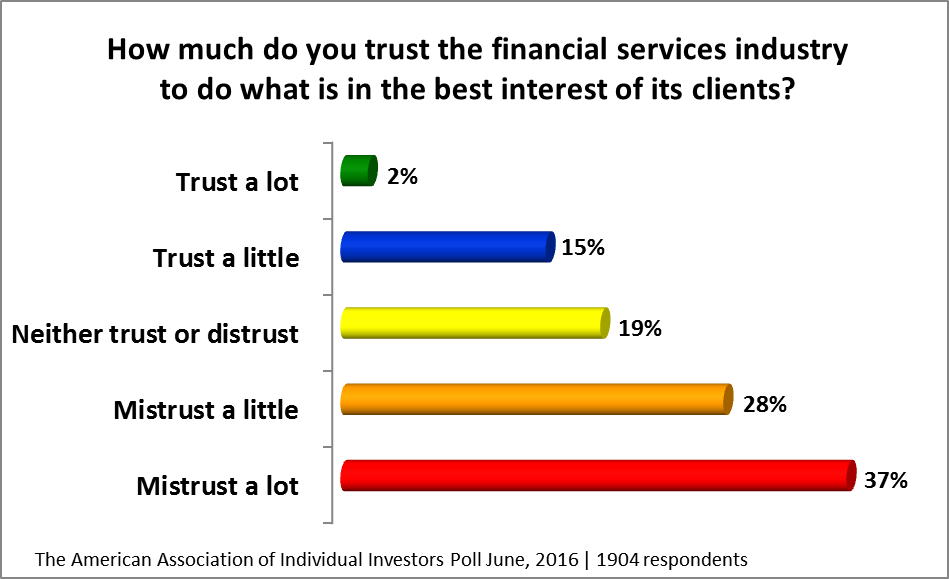

• https://www.zerohedge.comA surprising number of Americans who have financial advisors don't trust them to act in their best interests. In a 2016 poll by the American Association of Individual Investors (AAII), 65% of respondents said they mistrust the financial services industry to some degree. In fact, only 2% of respondents claim to trust financial professionals "a lot," while 15% say they trust them "a little."

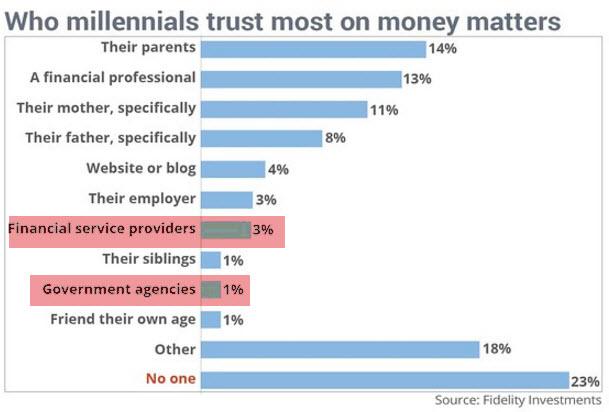

It isn't just the "Baby boomer" generation who have "lost trust," but the up and coming millennial generation as well.

Can you blame them?

After two major bear markets, years of retirement savings goals were wiped out. More importantly, financial plans which depended on 6%, or more, in annual returns were decimated due to the time lost in getting to retirement goals. This isn't just recently; this has been the case throughout history.

All those promises of "buy and hold" investing cranking out 7-8% average annual rates of return, every single year, have simply not happened. The chart below of real S&P 500 returns from 1965 to present with forward return projections, illustrates the problem.

The forward projections are based on two assumptions:

Current valuations which suggest weaker front loaded returns, and;

Stocks remain in a longer-term trend of 7% average growth.

This is for example purposes only to show the issue of variable versus average rates of return.