IPFS News Link • Stock Market

Nomura Has "A Word Of Warning For The Coming Days"

• https://www.zerohedge.comEarlier this week, Nomura's Charlie McElligott made an explicit warning that the market is entering a potentially turbulent period, one where even as broader equity markets declined, selling triggers for the trend-following, CTA community were rising, and once the two levels crossed, stocks could see an accelerated move to the downside as CTAs, most of whom are currently "Max Long" US equities, started selling again. This is precisely what happened with the Russell 2000 yesterday, resulting in a violent small-cap selloff.

For those who missed it, Charlie lays it out again this morning, noting that due to the extremely over-weighted impact of the 1Y period in our Nomura QIS CTA Trend model, "the powerful post 2/5/18 rally into this time period one year ago would "mechanically" drive currently "Max Long" US Equities futures "sell-trigger" levels HIGHER across the beginning of March", and thus even just a smallish pullback in Equities could then see the multi-month "Max Long" U.S. Equities position "at risk of seeing this very leveraged (and "unemotionally" rules-based) strategy turning OUTRIGHT SELLERS, as these breakpoints move higher / closer to ATM.

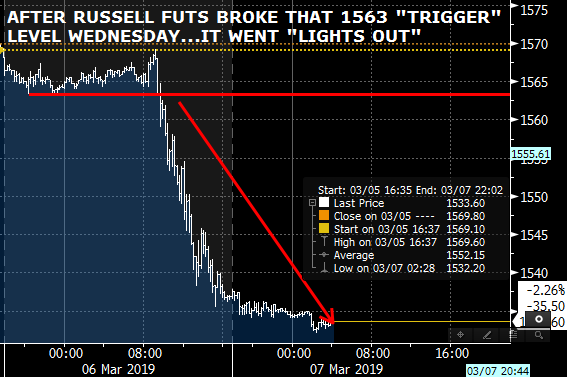

Then on Tuesday, as we highlighted at the time, McElligott showed the model's projected forward drop-off data across US Equities futures, where he specifically noted the imminent nature of the CTA position in Russell 2000 already technically below the "SELL PIVOT" level—so specifically if "day 0" was Tuesday, "day 1"—yesterday—only needed to cross through that 1563 level to see the prior "Max Long" inflect to an outright "Short" position again.

Indeed, as shown below, just a simple 50bps move lower in the Russell as the Nomura strategist forecast on Tuesday through 1,563 on Wednesday/Thursday, would have been sufficient to push the Russell 2000 from "Max Long" to "Short" again.

Whether or not this was the catalyst is unclear, but yesterday the Russell 2000 tumbled just as McElligott said it would, as Systematic Trend/ CTAs/Momentum models quite-evidently again turned "short" (-80% position now) in Russell 2000 futures:

So having been proven correct on the first key inflection point which clobbered small caps on Wednesday, McElligott has "a word of warning for the coming-days", to wit:

despite the clearly weakening 1Y signal in Russell (which per our model sees the CTA Trend universe as having pivoted "short"), we still sit near "re-leveraging" levels too—so the signal will be particularly noisy and at risk of "re-flipping"—especially with the 1Y dropoff dates moving our triggers around to such an extent, as I've been pointing out for two weeks now.