IPFS News Link • United States

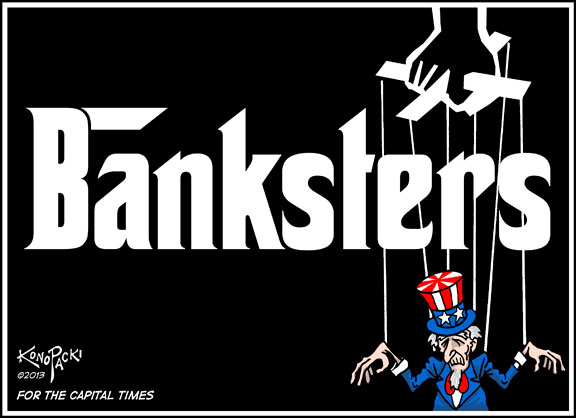

How the Banks Will Steal Your Money In the Coming Economic Crash

• http://www.thecommonsenseshow.com

Wells Fargo has been fined more than 12 bllion dollars for over 80 federal violations of banking law ranging from mortgage abuses, consumer protection violations, price fixing and violation of anti-trust laws, and a breach of trust with its investors resulting in fines for investor violations.

Wells Fargo has committed another violation of law ad this time it has to with an extreme violation of the First Amendment. Nikki Fried (D) is running for the elected position of Florida Commissioner of Agriculture and Consumer Services. Previously, Fried worked as a lobbyist for medical cannabis. Wells Fargo, my vote for the worst bank in America, is on the record as opposing medical marijuana. This personal opinion on the part of Wells Fargo management led to the bank to shut down the personal account of Fried in an extreme act of censorship. On the surface, this incident appears to represent just another extreme leftist plot to silence those that they disagree with. However, as I began to research on this topic, I discovered that the banking crisis in this country is at a crisis level and the majority of large banking chains are in very deep financial trouble. As my daddy used to say "poop rolls downhill". This refers to the fact that the banks are not going to suffer in isolation. As a result of the current banking crisis, every account holder in America is going to be dramatically impacted. The extent of the crisis may lead many of us to refer to 1929 as the good old days.

From The Wall Street Journal (February, 2018):

Banks are closing branches at the fastest pace in decades, as they leave less profitable regions and fewer customers use tellers for routine transactions.

The number of branches in the U.S. shrank by more than 1,700 in the 12 months ended in June 2017, the biggest decline on record, according to a Wall Street Journal analysis of federal data.

From KPVI's story on the most corrupt bank in America:

Wells Fargo announced plans Friday to shut down more than 400 bank branches by the end of 2018.

That's on top of the 84 locations it closed in 2016. The acceleration of branch closures at Wells Fargo is a reflection of Americans' preference for online and mobile banking these days. 200 branches will be closed in the current calendar year, more than that in 2018.

Wells Fargo said the new branch closures haven't been fueled by the bank's fake account scandal. However, Wall Street analysts do see a link. Not only does Wells Fargo face rising legal and compliance costs to clean up the mess, but its branches aren't likely to be the profit engines they once were.