IPFS News Link • Economy - International

Deutsche Bank: Europe's Ticking Time Bomb

• The Corbett Report - James CorbettYou have no doubt heard by now about the precarious situation that Deutsche Bank finds itself in, including the impending US government fine for selling faulty mortgage-backed securities in the run up to the financial crisis. The lamestream media is busy running stories about German bailout rumors, and bank's uncanny ability to not quite die…yet. But in case anyone is tempted to draw comparisons with the 2008 financial crisis, rest assured that the failure of Deutsche Bank would be no "Lehman Bros. moment." It would be incomparably worse.

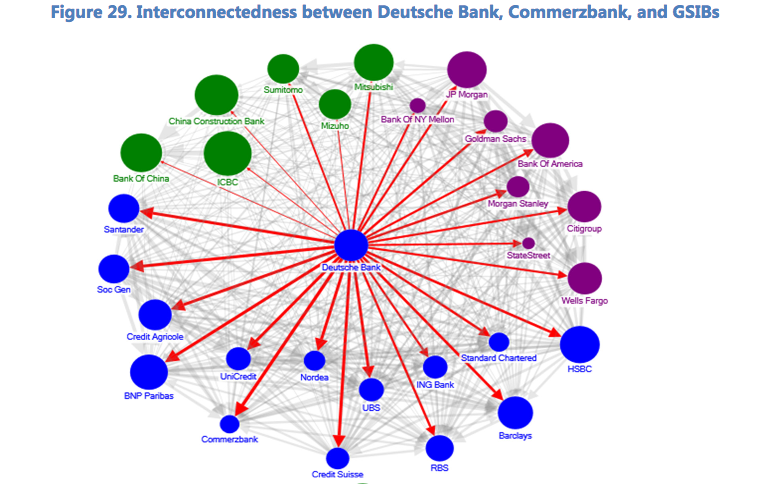

Deutsche Bank is not just one of the largest banking and financial services companies in the world (although it is that). It is also one of the most inter-connected banks in the world. As the IMF helpfully pointed out earlier this year:

"Deutsche Bank is also a major source of systemic risk in the global financial system. The net contribution to global systemic risk is captured by the difference between the outward spillover to the system from the bank and the inward spillover to the bank from the system based on forecast error variance decomposition. Deutsche Bank appears to the most important net contributor to systemic risks in the global banking system, followed by HSBC and Credit Suisse. Moreover, Deutsche Bank appears to be a key source of outward spillovers to all other G-SIBs as measured by bilateral linkages."

And here is the handy dandy diagram they provided to demonstrate those "bilateral linkages" that could contribute to "outward spillovers" to the other "G-SIBs" (that's "globally systemically important banks" to all of you not versed in Bankster-speak):

But more to the point, this doesn't just mean that their CEOs play golf together every year or two. These linkages include derivatives counterparties. What this diagram is really showing us is that when/if Deutsche Bank goes under it will create a derivatives black hole that threatens to draw in most of the largest financial institutions in the world…each one of which would then create its own black hole of derivatives debt.

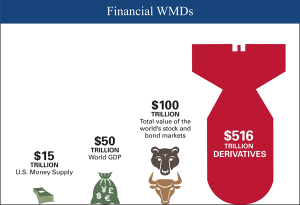

Now you'll remember that derivatives are bets on the performance of some other thing, like an asset, index, interest rate, etc. Like any bet, it can happen between two or more people and things can get very messy when one of the people involved doesn't have the money to pay up in the end. But derivatives can get even more wild, since the amounts in question can add up to trillions of notional dollars, i.e. money that does not actually change hands…unless everything falls apart and someone is left holding the bag.

This is why Warren Buffett famously referred to derivatives as "weapons of mass destruction." This is also why the 2008 crisis was so severe. If AIG had not been bailed out then its $527 billion in credit default swaps with Goldman Sachs, Morgan Stanley, Bank of America and Merrill Lynch (as well as DB and dozens of other European banks) would have unwound and potentially brought down the global financial system. And so the banksters held the proverbial (or not-so-proverbial) gun to Congress' head and achieved the largest bailout in corporate history.

This is why Warren Buffett famously referred to derivatives as "weapons of mass destruction." This is also why the 2008 crisis was so severe. If AIG had not been bailed out then its $527 billion in credit default swaps with Goldman Sachs, Morgan Stanley, Bank of America and Merrill Lynch (as well as DB and dozens of other European banks) would have unwound and potentially brought down the global financial system. And so the banksters held the proverbial (or not-so-proverbial) gun to Congress' head and achieved the largest bailout in corporate history.

So if all of that was done on the basis of AIG's half-a-trillion or so in counterparty risk, what are we looking at with Deutsche Bank?

Well, in 2013 its notional derivative exposure was 55.6 trillion euros. Let's put that in perspective with a graphic from ZeroHedge comparing DB's derivative exposure to the Gross Domestic Product of Germany.