IPFS News Link • Economy - Economics USA

One of These People Could Be the Next U.S. Treasury Secretary

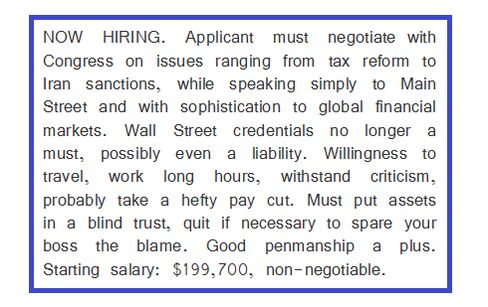

• http://www.bloomberg.comIt's a recruiting challenge for even the savviest presidential campaign — finding the ideal candidate for a job like this:

The role is U.S. Treasury secretary — spokesperson for the world's reserve currency, economic cheerleader, financial market regulator, signatory of the almighty buck.

With Republicans Donald Trump and Ted Cruz, and Democrats Hillary Clinton and Bernie Sanders, dominating their bids for their parties' nominations, Bloomberg spoke to analysts, campaign staff and former officials to start the guessing over who will succeed Jacob J. Lew in the house Hamilton built.

What follows is a list based on who's advising the candidates, donating to them and aligning with their ideologies. An important caveat is that a lot can change in the months ahead and no such lineup for this Senate-approved position is complete this early in the game; a couple Treasury secretaries in the past few decades were indeed dark horses (think railroad executive John Snow in the George W. Bush administration).

Photographer: Andrew Harrer/Bloomberg

Lael Brainard (Clinton)

A Federal Reserve governor since June 2014, Brainard, 54, has ties to the Obama administration and Team Clinton. She previously spent four years at Treasury — most recently as undersecretary for international affairs — and was an economic adviser and G-7 sherpa during Bill Clinton's presidency. Her husband, Kurt Campbell, was then-Secretary of State Hillary Clinton's top official for East Asia and the Pacific. In an unusual gesture for a senior Fed policy maker, Brainard, who declined to comment for this story, has donated the maximum for an individual — $2,700 — to the Clinton campaign. Achilles' heel: Her Democratic loyalty may be perceived as too partisan for some key Republican senators.

Photographer: Andrew Harrer/Bloomberg

Gary Gensler (Clinton)

The next Treasury secretary may already be working for Clinton. Before becoming chief financial officer of her presidential campaign, Gensler, 58, was chairman of the Commodity Futures Trading Commission, playing a lead role drafting and implementing the Dodd-Frank Act. The former Goldman Sachs Group Inc. partner was a champion for tougher Wall Street regulation and was viewed as a top ally to financial reform advocates and a thorn in the side of big business. Gensler didn't respond to request for comment through the Clinton campaign team. Achilles' heel: His tenure as an aggressive regulator may have alienated his old Wall Street friends and plenty of the Senate lawmakers he'd need to confirm him.

Photographer: Chris Kleponis/Bloomberg

Phil Gramm (Cruz)

Cruz named the former senator as an economic adviser last month. As Senate Banking Committee chairman, Gramm, 73, co-wrote the Gramm-Leach-Bliley Act of 1999, eliminating barriers between banks, insurance companies and securities firms. In 2008, while working as an economic adviser and co-chair of John McCain's presidential campaign, Gramm dismissed the downturn as a "mental recession." Gramm has a Ph.D. in economics from the University of Georgia. He declined to comment. Achilles' heel: Some critics blame the 2008 financial crisis partly on the legislation he co-authored to remove the firewall between banks and securities firms.

Photographer: Victor J. Blue/Bloomberg

Carl Icahn (Trump)

Few may imagine that a contrarian investor who says he makes money by studying "stupidity" might be the next Treasury secretary. But nothing seems too far-fetched with Trump, who has floated Icahn as a possible candidate for the job. Icahn, who has a $20.3 billion fortune and ranks 32nd on Bloomberg's list of richest people, initially said he wasn't interested. But after watching Trump in a televised debate, the 80-year-old tweeted that he'd accepted the offer. Icahn's straight-talk style and media prowess is befitting of Trump's political approach. He didn't respond to a request for comment. Achilles' heel: Icahn would have to fight the perception that, as an activist investor, he's more focused on short-term profits than on long-term stability.

Photographer: Nelson Ching/Bloomberg

Henry Kravis (Trump)

In multiple TV appearances last summer, Trump was quick to name Kravis as a potential member of his cabinet. To which the co-founder of private equity firm KKR & Co. responded: "That was scary when he said that." Kravis's net worth of around $4.2 billion places him No. 376 on the Bloomberg Billionaire Index, enough for real cred with Wall Street. An Oklahoma native who's spent his career in New York finance circles, Kravis, 72, brings the perspective of a Washington outsider. He didn't respond to request for comment. Achilles' heel: The coziness to Wall Street may make some senators squeamish.

Photographer: Matthew Staver/Bloomberg

Robert Reich (Sanders)

Reich, 64, served as Bill Clinton's first-term secretary of labor. Feeling the Bern this election cycle, Reich is a chief economic surrogate for Sanders and has gone to bat for him, including versus former White House Council of Economic Advisers chairs who slammed Sanders's budget plan as unrealistic. Given Reich's crusade against income inequality, the match makes sense. "I wouldn't go back to Washington with my heart fluttering and tail wagging, but I'd go because I consider it a public duty," the University of California Berkeley public policy professor said in a statement. Achilles' heel: His left-of-left-leaning economic views could be seen as too far outside the mainstream.