IPFS News Link • Housing

3% Downpayment FHA Loans Surge As Subprime Buyers Are Back In The Housing Market

• Zero HedgeAs such, many potential first time buyers have been sidelined despite the availability of meager 3% downpayment loans from the FHA as well as Fannie Mae and Freddie Mac.Fortunately for the U.S. ponzi scheme economy, the U.S. government has a solution. Lower mortgage insurance premiums.

First-time homebuyers are finally jumping into the U.S. property market.

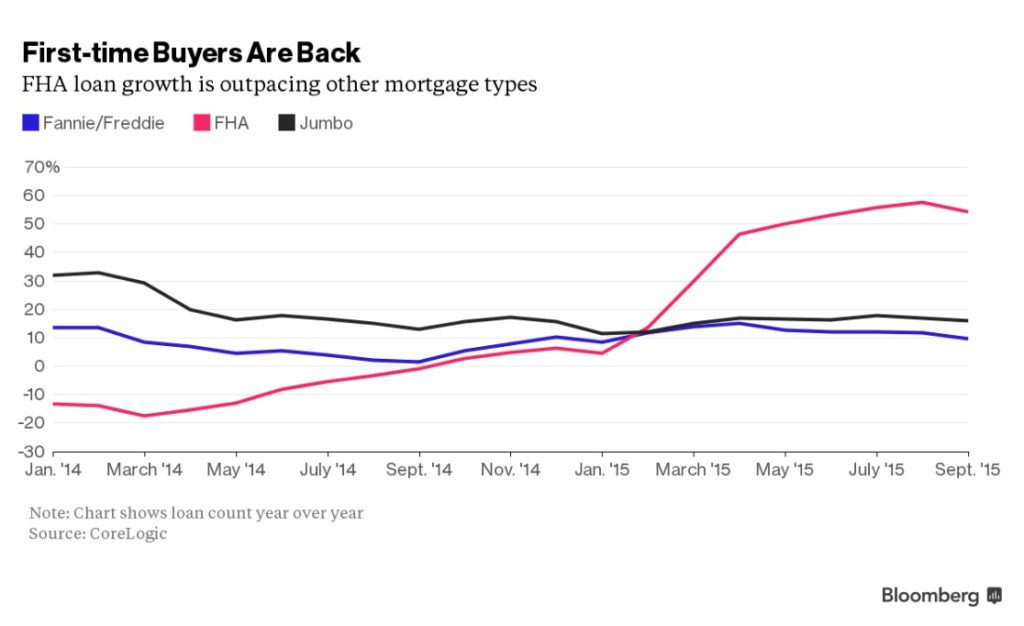

Need proof? Look at the mortgage market's fastest-growing segment: loans with low down payments insured by the Federal Housing Administration.

Originations of FHA-backed mortgages, used predominately by first-time buyers, were up 54 percent in September from a year earlier, according to the most recent data from CoreLogic Inc. By December, the FHA insured 22 percent of all loan originations, up from 17 percent a year earlier, according to data compiled by Ellie Mae Inc.

Yes you read that right. Up 54%.

President Barack Obama's administration, in January 2015, reduced mortgage-insurance premiums for FHA loans. That lowered the cost of getting a home loan and brought in at least 75,000 new borrowers with credit scores of less than 680, according to a November report from the U.S. Department of Housing and Urban Development.

The rate of FHA lending, which had been in decline through most of 2014, tripled the month after the insurance premium was cut, according to CoreLogic.

This chart says it all: