IPFS News Link • Economy - Economics USA

Goldman to Bond Traders: You're Underestimating U.S. Inflation

• http://www.bloomberg.comBond traders' inflation expectations are way too low, say analysts at Goldman Sachs Group Inc.

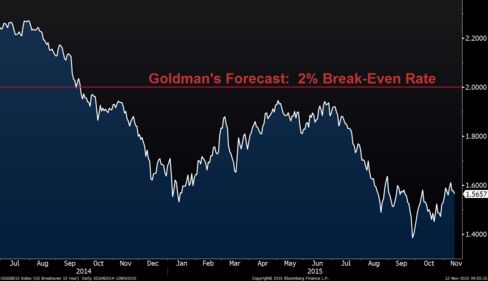

Sliding energy prices and slowing global economic growth have weighed down a measure of inflation expectations known as the 10-year break-even rate -- the gap between yields on Treasury notes and inflation-linked debt of that maturity. The gauge has rebounded from a six-year low set in September, and Goldman Sachs says it's poised to keep climbing as oil prices stabilize and the U.S. economy accelerates. Rick Rieder, chief investment officer of fundamental fixed income at BlackRock Inc., wrote in a separate note that the drop in oil distorts inflation readings.

The Goldman analysts predict the break-even rate -- at about 1.57 percent -- will jump to 2 percent, though they don't specify a timeframe. At that level, the market's forecast for inflation would match the Fed's goal, and it would be closer to the 15-year average of 2.1 percent. To profit from the projection, the bank recommends buying inflation-linked 10-year Treasuries versus regular notes.

"The market is way too bearish on U.S. inflation in the medium term," meaning between five and 10 years, said Silvia Ardagna, an analyst in London with Goldman Sachs, one of the 22 primary dealers that trade with the Fed.

A rebound in the bond market's inflation view would signal rising investor confidence in the Fed's ability to increase interest rates without derailing the economy. Stronger-than-forecast U.S. jobs data on Nov. 6 backed up the case for the central bank to boost its benchmark rate from near zero at its meeting next month.